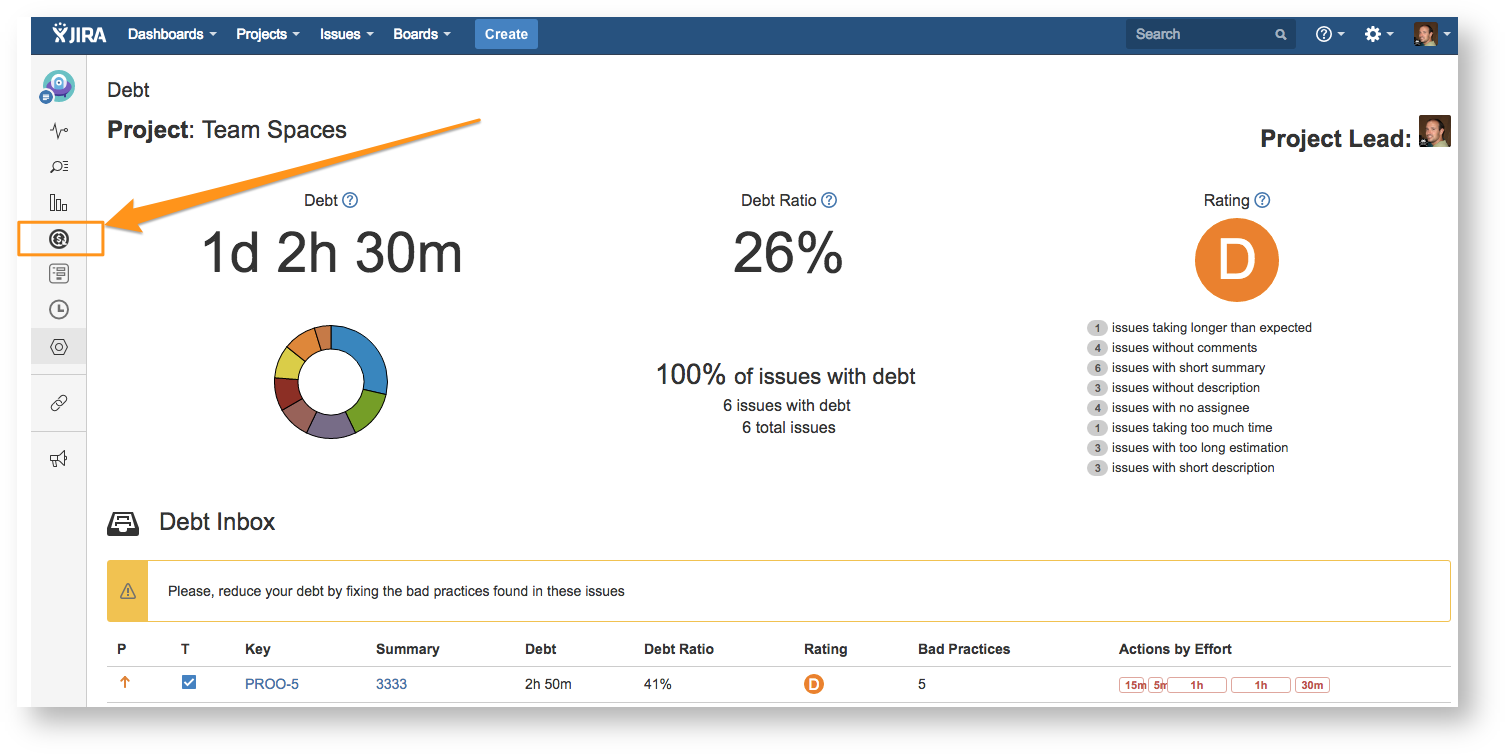

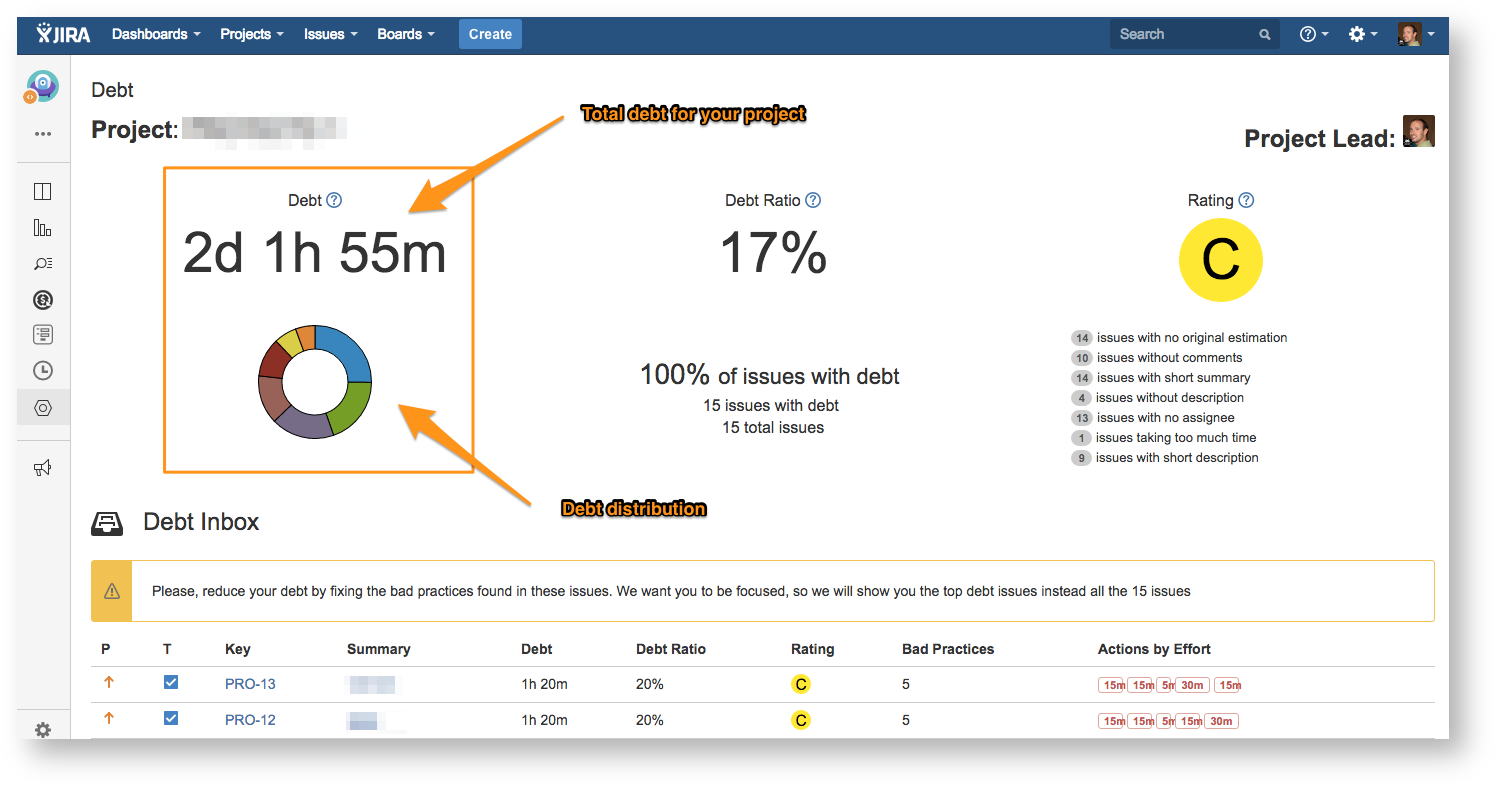

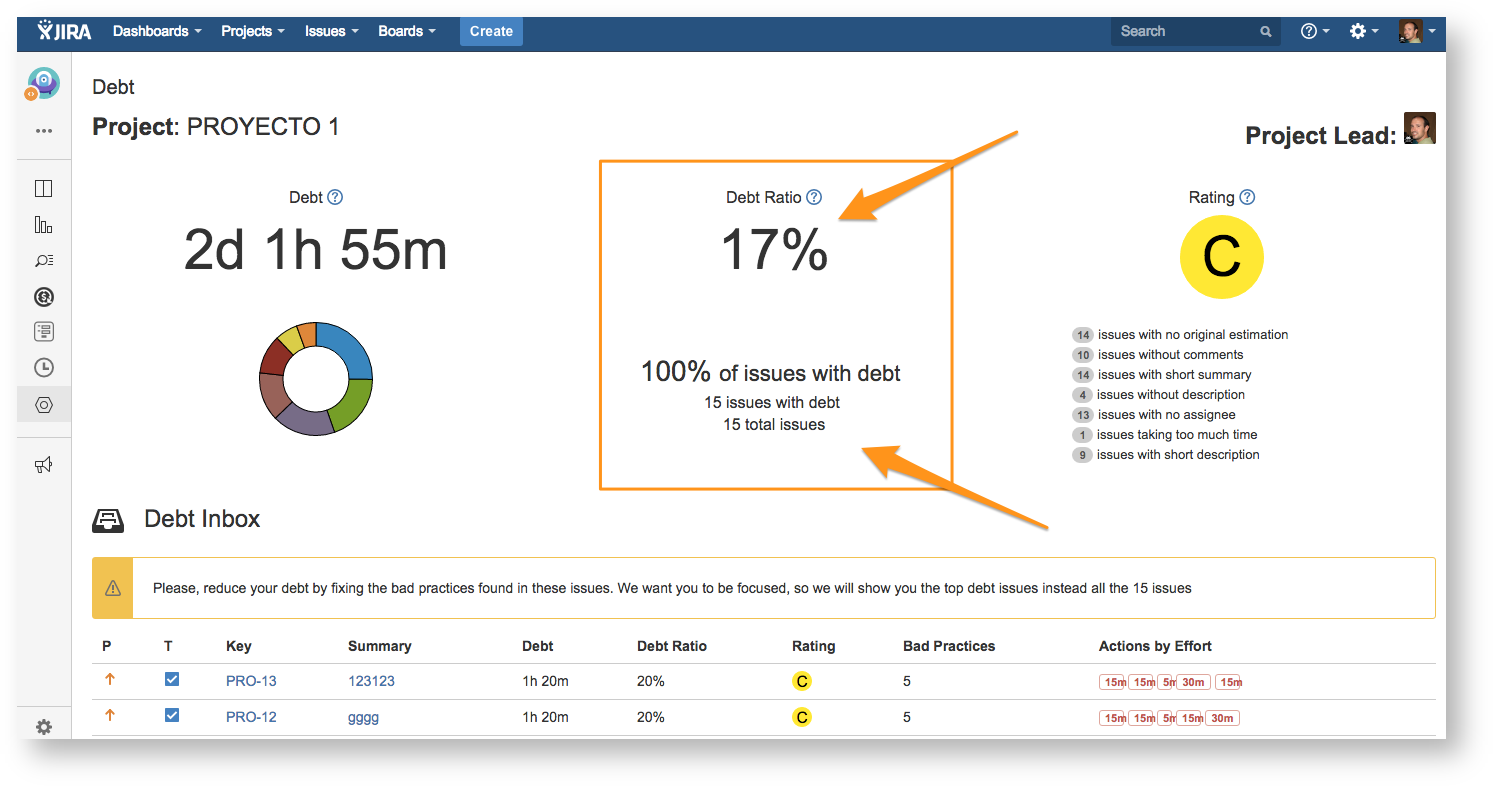

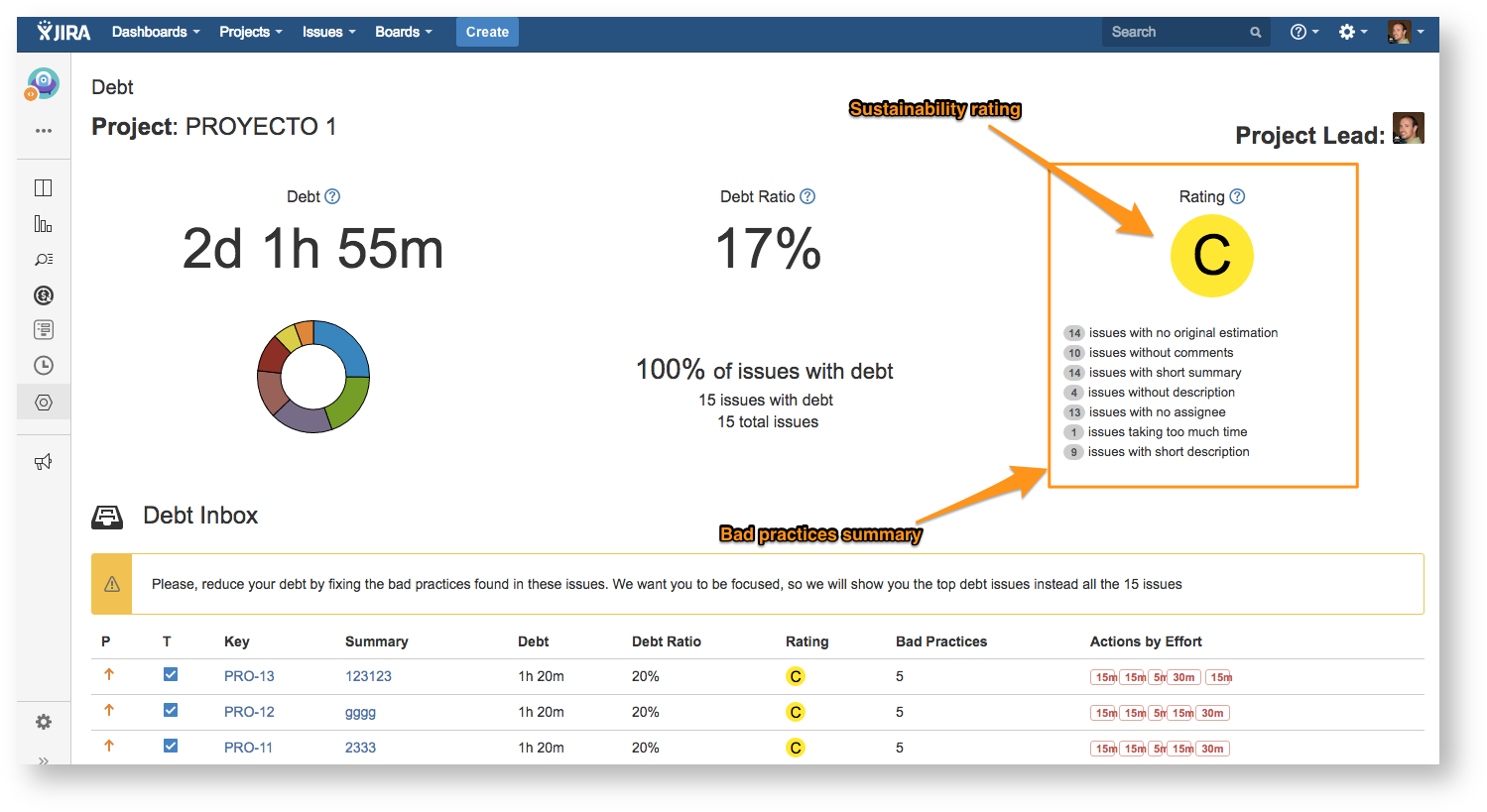

You can browse your project debt at anytime by using the project tab panel in your project sidebar. You will access the full debt dashboard with all your debt summary and details:

How do we calculate the debt in JIRA?

Total debt for the project

Debt Assessment is performed by reviewing all the issues of your project and finding bad practices (rules that are checked against the issues).

Debt Assessment is performed by reviewing all the issues of your project and finding bad practices (rules that are checked against the issues).

We have defined a remediation cost for each bad practice in our debt model.

The total amount of debt is the sum of the remediation costs for all the bad practices found in all the issues.

Debt distribution

Below the total amount of debt you can find a debt distribution chart where you can specifically check what kind of bad practices are causing the most of your debt.

Below the total amount of debt you can find a debt distribution chart where you can specifically check what kind of bad practices are causing the most of your debt.

You just need to put your mouse over the graph to see the information about the bad practice and the current debt.

What's is the debt ratio?

Debt Ratio

According to the debt metaphor, the debt ratio is the overrun of your project due to bad practices.

In our debt model, the debt ratio value gives the ratio between the actual debt and the maximum debt value for your project. The latter is estimated using the debt for each bad practice and the number of issues in your project.

Issues with debt

It is the percentage of issues where the Debt Tracker found bad practices. Below you can find the exact number of issues with debt and without debt.

It is the percentage of issues where the Debt Tracker found bad practices. Below you can find the exact number of issues with debt and without debt.

Debt Rating

Debt Rating

This rating gives you your project sustainability. Giving the value of the debt ratio the project gets a rating going from A (best grade) to E (worst grade).

You can use this rating to compare different projects.

Bad practices summary

In addition to the debt distribution you can also check how many issues for each bad practice. This is very helpful because it lets you know your project management weakness.

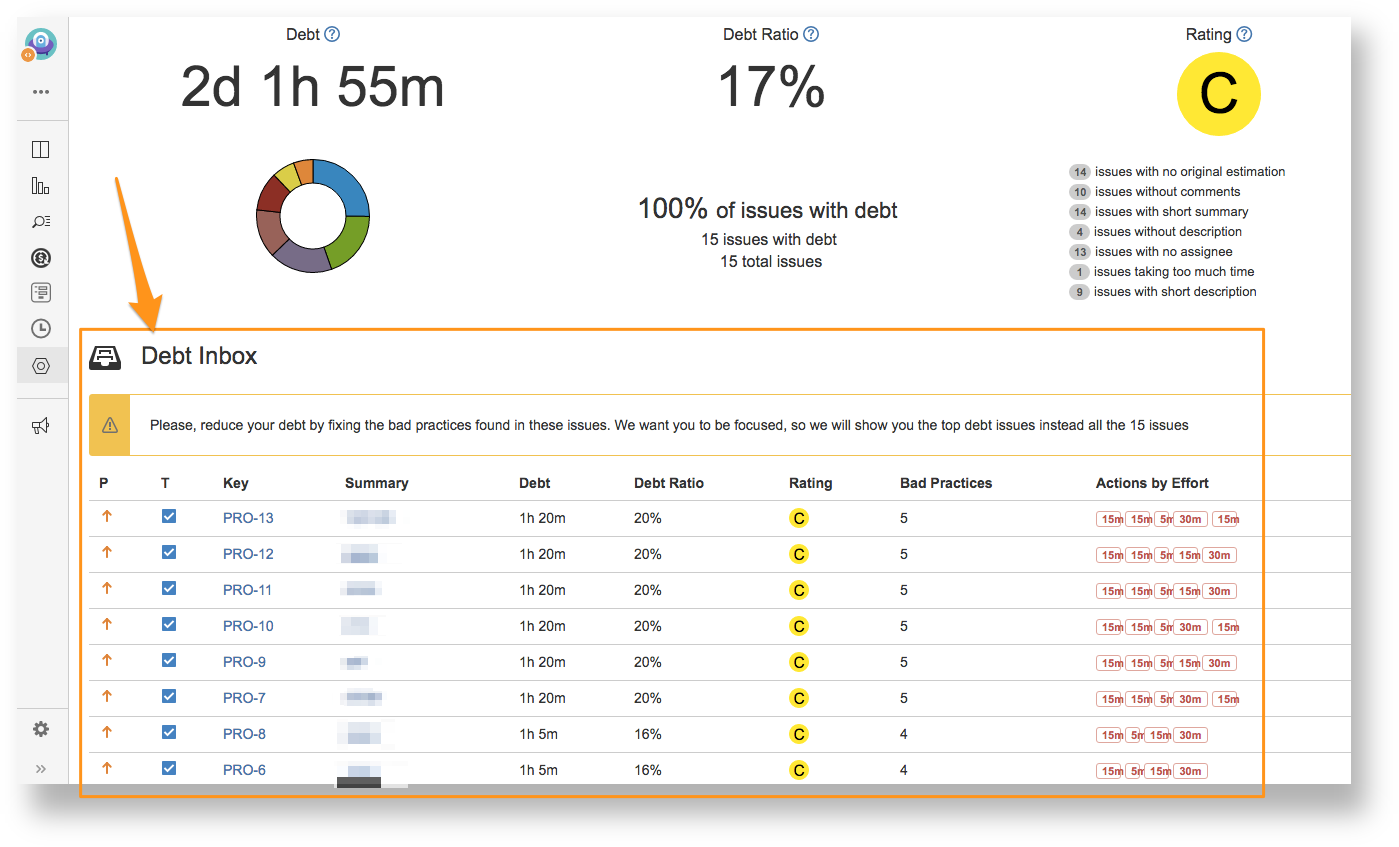

Debt Inbox

Debt Tracker and Assessment for JIRA will show you a set of issues in order to help you remediate your debt. This is called the Debt Inbox.

It will only show you a top 10 issue list. This is because you must be focused in a minimum set of issues instead of a too big list that you will never fix.

The inbox will be filled at first with not resolved issues, because those are issues where you are supposed to be working on, and it will be easier for you to fix them.

As soon as the debt is remediated in not resolved issues the Debt Inbox will show you the resolved ones.

Debt Inbox Issue Information

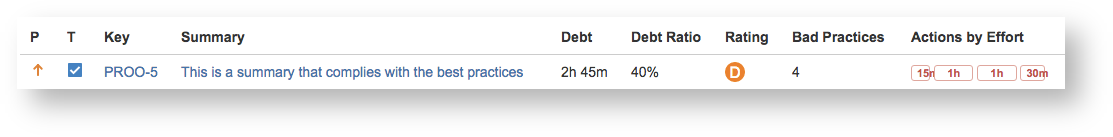

The Debt Inbox table will show you several details for the issues:

- Priority, Issue Type, Key and Summary: these fields identify the issue so that you can quickly navigate to them and see what happens.

- Debt: this is the total amount of debt associated with this specific issue. Total debt is the remediation cost of all the bad practices found in the issue.

- Debt Ratio: gives the ratio between the actual debt and the maximum debt value for the specific issue.

- Rating: giving the value of the debt ratio the issue gets a rating going from A (best grade) to E (worst grade).

- Bad Practices: this is the number of bad practices found in the issue.

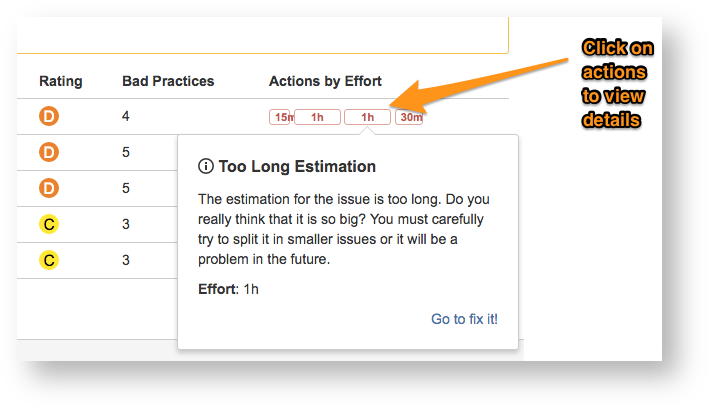

- Actions by Effort: gives you additional information about the best practices found in the issue and gives you hints to solve them. These actions are displayed using the remediation cost associated to the bad practice.